Share

UFCW Local 653 President Matt Utecht began thinking about the solvency of the members’ private pension plan about two years ago at church. He had come to know an older couple in their late 70s. The gentlemen of the pair was a proud retired union member who consistently wore his union branded clothing to service.

One day, Utecht approached the older couple, observing that they looked upset. They had recently found out that the husband’s multiemployer pension plan had lost a substantial portion of its value.

Their situation hit Utecht hard, as the couple reminded him of his own parents. Utecht remembered thinking,

“Here is this proud old-timer who has given the best years of his life to an employer and had counted on a retirement benefit, and had just found out that his benefit would be reduced by half. He was so defeated and dejected. When they are supposed to enjoying the time they have left together, devastation hits,” Utecht said.

According to a December 2017 report from the Center for Retirement Research, the instability of multiemployer pension plans are rooted in two central issues.

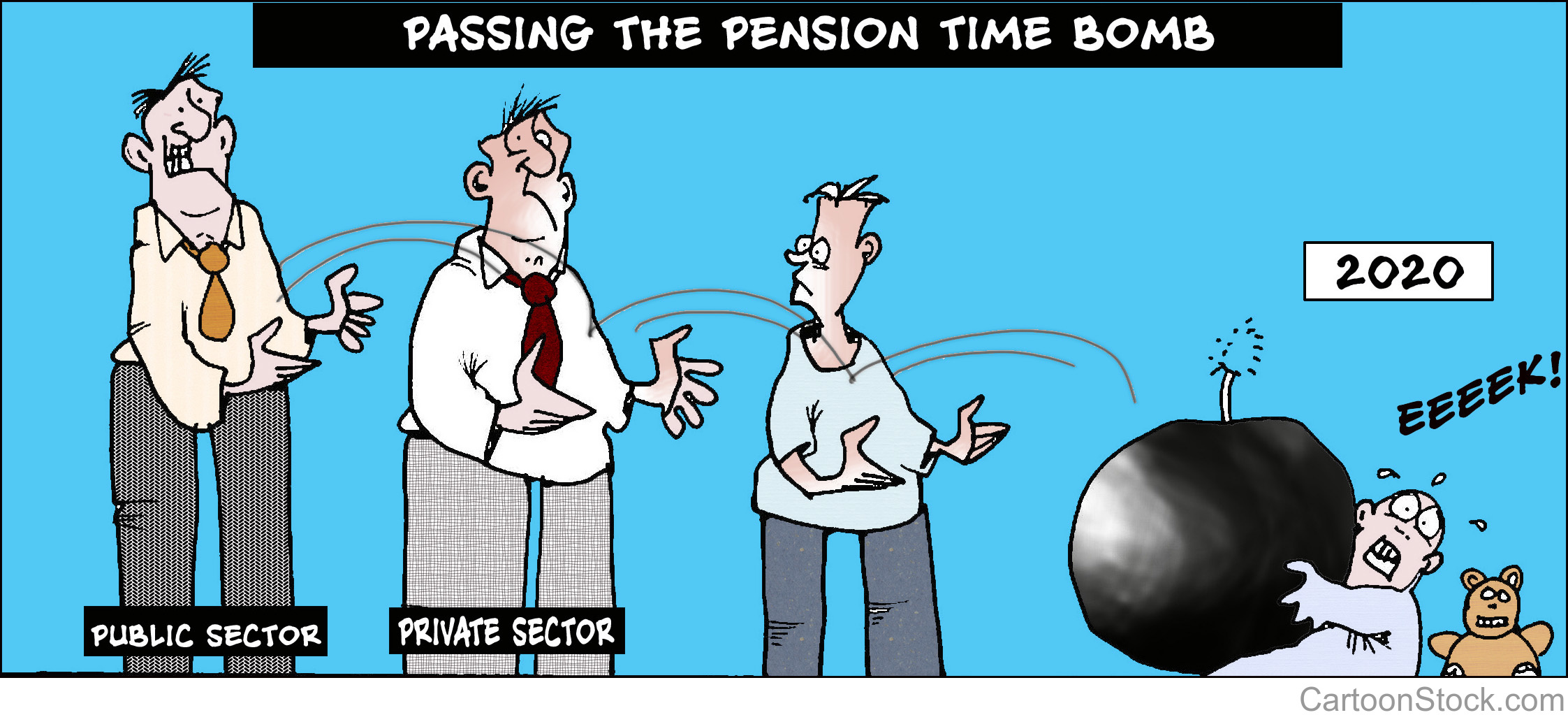

First, aging workers are not being replaced, as union jobs that fund multiemployer plans have been disappearing due to outsourcing, bankruptcy, or the lack of union jobs. Therefore, today there are substantially less new unionized workers to pay into the pension system.

Secondly, the dot-com bubble in 2000 and subsequent economic shocks have gutted the investment returns that funded these plans.

The looming multiemployer pension crisis instilled a sense of urgency in Utecht to confront the issues and make appropriate plans to protect UFCW members from the dejection that he had witnessed from the older couple.

Problems with Pensions

In the United States, the defined benefit (DB) private pension system was not legislated into existence but rather came as a result of organized labor bargaining with large employers to protect the interest of workers long after they had given their youth to their employer. Today, these pensions are in crisis following major economic shocks over the last 15 years. Corporate mismanagement has also plagued these systems.

According to Bloomberg, General Electric has the highest pension liability among S&P 500 companies, approximately $28.7 billion. GE closed 2017 with $100.3 billion in obligations to over half a million people against $71.6 billion in assets. Longtime and recently resigned CEO Jeff Immelt created the problem by emphasizing acquisitions, mergers, and stock buybacks. These decisions enriched shareholders instead of protecting long-term commitments to workers.

Furthermore, the use of these pensions has declined with the weakening of organized labor and employers’ shift to their preferred defined contribution (DC) plans such as 401(k)s. DCs put the financial liability on the employee rather than the employer. Furthermore, the original intent of DCs was to create a plan that provided supplemental benefits, not necessarily replace traditional (DB) pensions.

Defined contribution plans have shown to be riskier, as many of these plans collapse during an economic crisis such was the case of Enron. Furthermore, many cash-strapped workers with 401(k)s have been raiding them in order to pay for unexpected expenses like rising health care costs or mortgage issues and other threats that have arisen from the ongoing impacts of recent economic downturns.

Variable Annuity Pension Plan

Utecht began working with pension expert David Blitzstein. Together, they began exploring a “variable annuity pension plan.” This plan has been available since 1953 but fell out of favor and was not widely adopted.

The plan functions similarly to a traditional defined benefit pension. It is still a defined benefit and pays a lifetime annuity; however, it involves risk-sharing on the investments that fund its growth between employers and employees. The highly regarded Wisconsin State employee pension is a variable annuity plan along with the Major League Baseball Players Benefit Plan. Local 653 is the first UFCW Local in the United States that has bargained for a variable annuity plan.

Because the benefit is variable there is more potential for benefit. If the annual return is above a “hurdle rate” there is an automatic increase in benefits. If returns fall below the hurdle rate benefits can be reduced; however, Local 653 negotiated restrictions on decreases with grocers. UFCW expects to propose this plan to the Seward Community co-operative during their ongoing bargaining.

Debate on Pensions

There is a fierce debate circulating on what to do about public pensions.

Kurt Winkelmann is a Senior Fellow at the Heller-Hurwicz Economics Institute at the University of Minnesota. One of institutes’ focus is examining the state of public pensions and, in their view, the reform necessary to stabilize public pensions.

According to Winkelmann, “We [United States] have the worst of the worst. We don’t have good defined benefit [DB] program plans because they are underfunded. Up until recently, and I would say it’s incomplete, we don’t have good defined contribution [DC] systems.” Utecht explained that UFCW considers a 401(k) to be a savings plan, not a retirement plan, and therefore not a viable replacement.

Instead of offering solutions to the problems, Winkelmann sees his role as convening with stakeholders to discuss tradeoff and therefore be in the best position possible to decide what to do. Most of the funding for Winkelmann’s research is from the Arnold Foundation. The Arnold Foundation is primarily funded by former Enron trader and billionaire John Arnold.

Unions contend that the Arnold Foundation is funding efforts to privatize public pensions across the United States and convert them to 401(k)-style defined contribution (DC) plans. Whether the Foundation is guiding Winkelmann’s research, he responded by saying, “The way they have treated us is pretty hands-off. I think they just want thoughtful analysis.” He further emphasized, “Am I trying to argue for privatizing? Not really. I just want a sensible conversation about tradeoffs.”

Nevertheless, Arnold and the foundation bearing his name remain controversial. Rolling Stone described him as a, “young right-wing kingmaker with clear designs on becoming the next generation’s Koch brothers, and who for years had been funding a nationwide campaign to slash benefits for public workers.”

Investigative Researcher David Sirota explains in his report “The Plot Against Pensions” that pension privatization advocates distort the debate by focusing state budget debates on slashing benefits and, “downplaying proposals that would raise revenue to shore up existing retirement systems”, among other things.

According to Sirota, the same sort of greed that has decimated private sector pension is impacting public pensions. Instead of states meeting their pension obligations, they instead offer tax abatements to politically connected corporations. Sirota notes that,

“Left out of the analysis, of course, was any note that Kentucky’s $760 million annual pension shortfall is far less than the $1.4 billion a year Kentucky spends so-called “incentive programs”—much of them classic corporate welfare. These programs have included subsidies of $300 million to Ford Motor Company, $205 million to Weyerhaeuser, and $110 million to United Parcel Service.”

These systems and the millions of dollars they wield are interrelated and impacted by state level policies and the unwillingness of corporations to meet their obligations.

The seriousness of this problem has led to the the Bipartisan Budget Act of 2018 (P.L. 115-123). It creates a new joint select committee of the House and Senate. It is currently in the process of making recommendations and drafting legislation that will, “significantly improve the solvency of multiemployer pension plans.”